Insights & Key Findings

Global FDI Outlook and Key Trends

Global FDI Inflows

Shifting Dynamics in Global FDI: Post-Crisis Plateau, Pandemic Impact, and Rise of Developing Countries

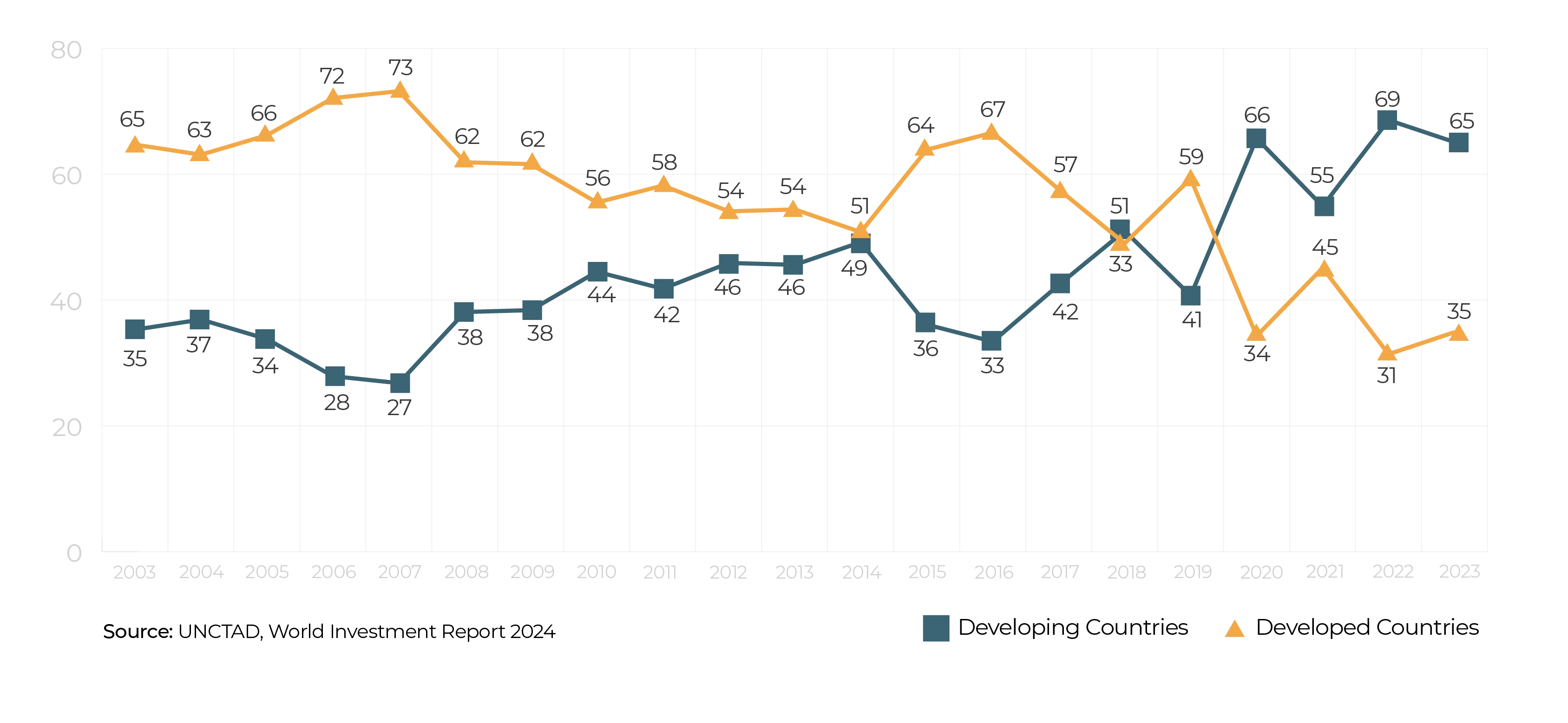

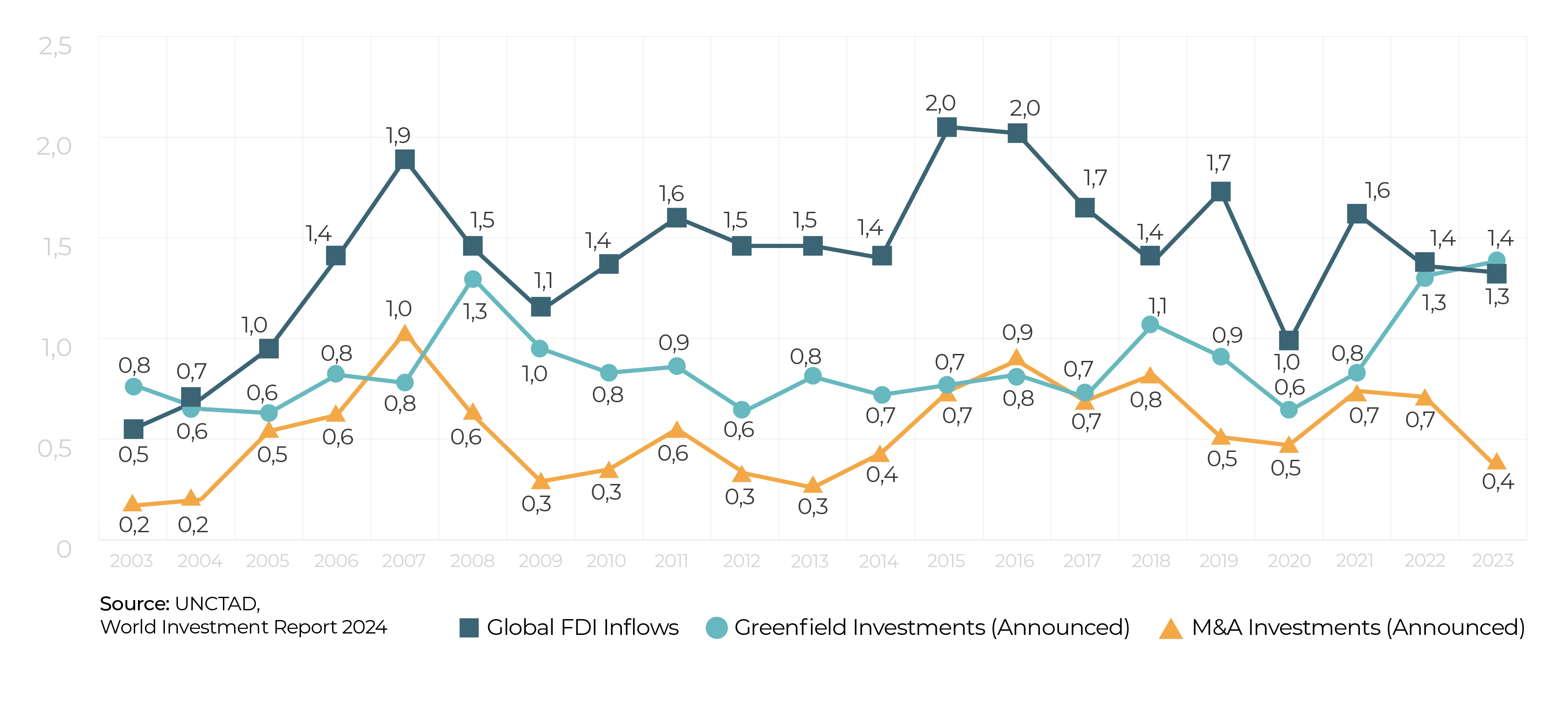

Global FDI inflows have remained stagnant since the 2008 financial crisis, with notable fluctuations in recent years. The COVID-19 pandemic caused a sharp decline in 2020, followed by a surge in 2021 driven by M&A transactions. However, this rebound was short-lived, as rising inflation and geopolitical tensions have recently contributed to a renewed downward trend. The pandemic also reshaped global supply chains, spurring increased investments in green and digital sectors. On the other hand, since 2018, developing countries have consistently outpaced developed nations in attracting FDI, a trend that has continued since 2020.

Share of Developed and Developing Countries in Global FDI Inflows (%)

Global FDI Inflows, M&A and Greenfield Investments(Trillion USD)

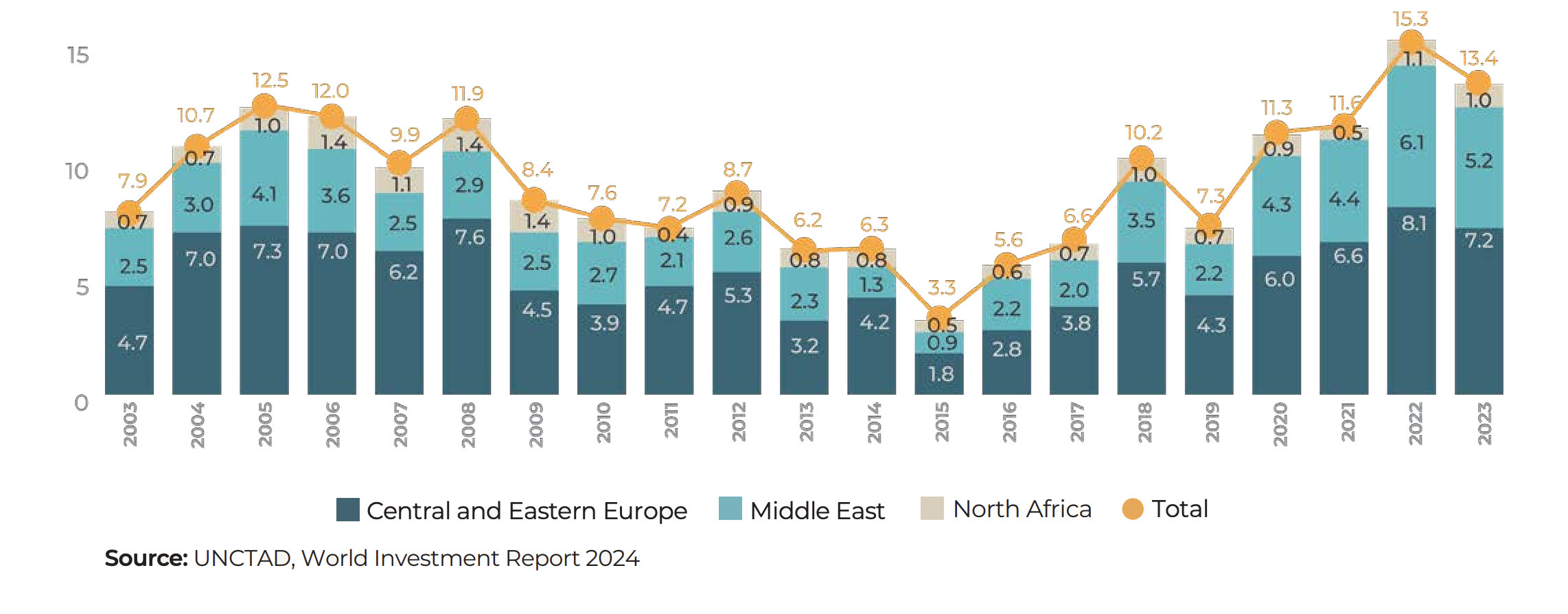

FDI Inflows in the Region

Türkiye’s unique location

Frequently shortlisted country

Regional resilience amid global FDI decline

Doubling inflows from 2015 to 2022

The Region's Share in Global FDI Inflows (%)

Türkiye stands as one of the most significant FDI destinations in the CEEMENA region.

Türkiye: Leading Investment Destination in Food, Agriculture, and Industrial Sectors in CEEMENA

8 Key Trends in Global FDI

Türkiye's FDI Performance

Over the past 20 years, Türkiye has emerged as an attractive FDI destination thanks to various factors, including continuous and strong reform agenda, economic and political stability, a young and dynamic population, and a strategic location it offers.

New Legal Regulations and Continuous Reform Process

Foreign Direct Investment (FDI) Law

Comprehensive Incentive Schemes

Strong Agenda for Sustainability and Green Transformation

Establishment of the Coordination Council for the Improvement of the Investment Environment (YOIKK)

Establishment of the Investment Office of Türkiye Reforms in Fundamental Laws

Judicial Reforms to Improve the Investment Environment

Strong Engagement with Ease of Doing Business / Business Ready (B-READY) Indices

Key Factors Lying Behind Türkiye’s Outstanding FDI Performance

- Continuous Economic and Political Stability

- Resilience Against Global Shocks

- Young and Dynamic Population

- Highly Skilled Talent Pool

- Robust Infrastructure

- Digital Transformation

- Vibrant R&D Ecosystem

- Geostrategic Location

- Customs Union with European Union (EU)

- A Wide Range of Free Trade Agreements

- Strong Integration into Global Value Chains (GVCs)

- Robust Economic Growth

- Production and Export Hub of the Region

Türkiye's Startup Ecosystem

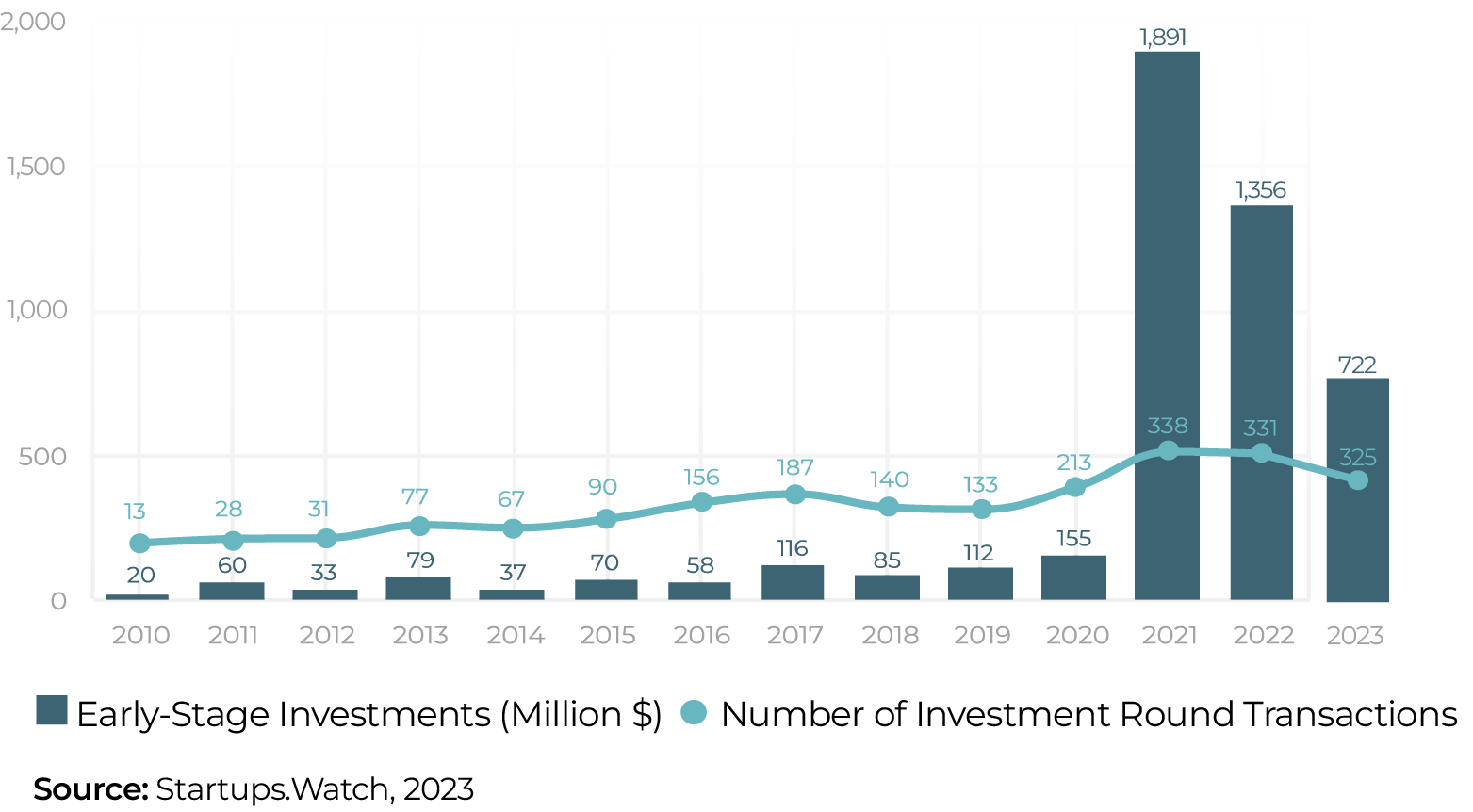

Türkiye’s Startup Ecosystem Reaches New Heights in Early-Stage Investments

Between 2010 and 2020, Türkiye’s startup ecosystem attracted $74 million annually through 104 transactions on average. From 2021 to 2023, investments soared to $1.33 billion annually, with an average of 338 transactions.

5

The Number of Unicorns

2020-2023

2

The Number of Decacorns

2020-2023

The Contribution of FDI to the Turkish Economy

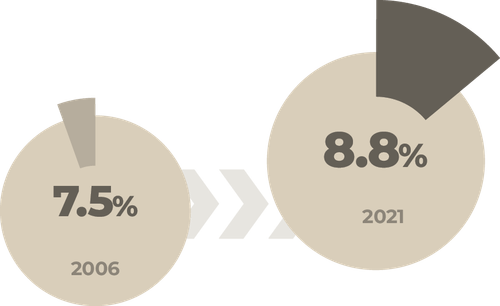

While the registered employment of FDI companies was around 500,000 people in 2006, it reached 1,320,000 in 2021.

The share of these companies in total registered employment in Türkiye increased from 7.6% in 2006 to 8.8% in 2021.

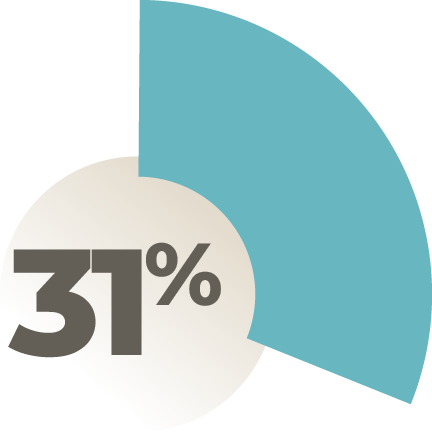

In the 2006-2021 period, approximately 31% of Türkiye’s total exports were made by FDI companies.

2.5 TIMES

INCREASE

While the exports of FDI companies were around 25 billion dollars in 2006, they increased to over 63 billion dollars in 2021.

61% MEDIUM HIGH-TECH & HIGH-TECH EXPORTS

In the 2006-2021 period, 61% of exports made by FDI companies consist of medium-high and high technology products. This rate is above the Turkish average.

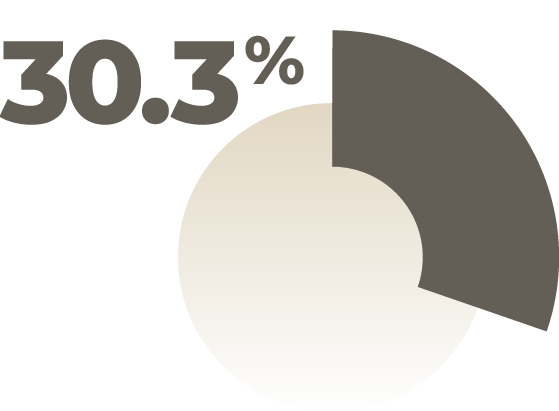

In the 2006-2021 period, 30.3% of the total private sector R&D expenditures in Türkiye were made by FDI companies.

730 TOTAL PATENT APPLICATIONS

FDI companies applied for an average of 730 patents annually.

6 TIMES INCREASE

During the 2006-2021 period, the number of FDI companies conducting R&D in Türkiye increased 6-fold.

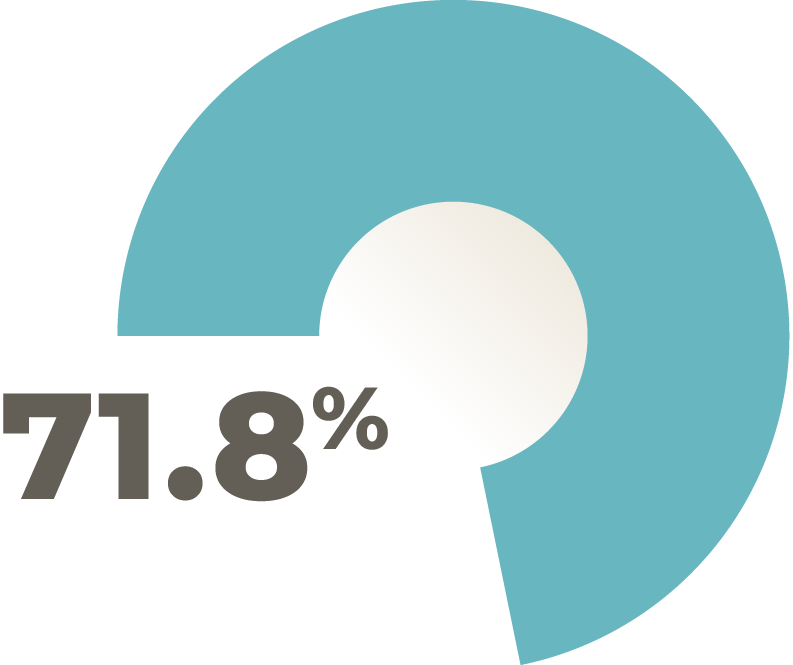

In the 2006-2021 period, FDI companies made 71.8% of their total supplies locally.

10 Key Findings Guiding the Strategy

As a result of detailed analyses of the global and regional outlook of FDI flows and the trends shaping this outlook, there emerged 10 key findings that guide the strategy. These findings made significant contributions to the definition of quality FDI profiles for Türkiye and the design of the policy areas put forward within the scope of the strategy.

Increasing Türkiye's FDI Share of Global FDI to 1.5%

1.5%

Increasing Türkiye’s Regional Share in FDI Inflows to 12%

12%

Achieving the 5-year Project Target for Each Quality FDI Profile

Climate FDI

Global Value Chains (GVCs) Are Being Reshaped

Digital FDI

Global Value Chains (GVCs) Are Being Reshaped

Global Value Chain related FDI

Global Value Chains (GVCs) Are Being Reshaped

High-End Service FDI

Global Value Chains (GVCs) Are Being Reshaped

High-quality Job Generating FDI

Global Value Chains (GVCs) Are Being Reshaped

Knowledge Intensive FDI

Global Value Chains (GVCs) Are Being Reshaped